Workforce Strategy in the Americas: All Is Far From Equal

Brazil ≠ Mexico ≠ America

Welcome to this issue of The Contingent Compass. Each week, I send two essays to help you navigate the complex world of the Contingent Workforce. If you need support on your journey, upgrade to a paid subscription where you’ll instantly be able to interact with the community through group chat, live Q&A’s, gain access practical program tools and useful how-to guides.

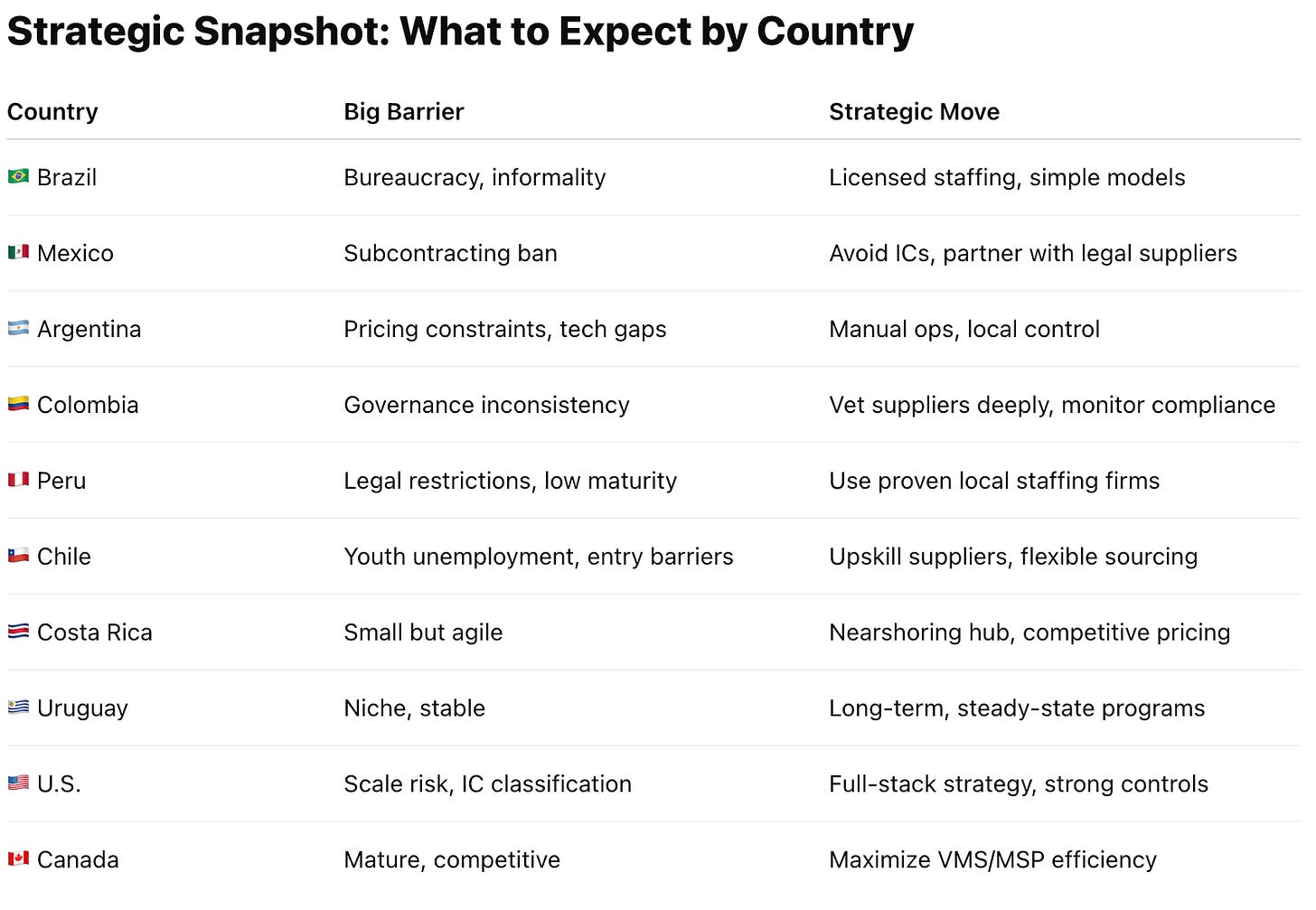

A practical guide to tailoring your contingent workforce approach to market complexity in the Americas.

If there’s one thing that will get a global contingent workforce program into trouble faster than a misclassified freelancer in France, it’s assuming all markets operate the same way. Spoiler alert: they don’t. 🧨

The latest 2025 reports on contingent labor complexity in the Americas confirms what many of us have experienced firsthand — building a contingent workforce strategy is a completely different beast in Brazil than it is in Boston. The variables? They’re everywhere: regulatory environments, labor laws, staffing market maturity, MSP/VMS coverage, tech infrastructure, even how easy it is to fire someone (or not). 🧾⚖️

The most recent industry reports evaluate ten major markets across 12 criteria, from economic uncertainty to employment rigidity. But what do we do with all the data? That’s what this essay is for — a practical guide to tailoring your strategy to the quirks and chaos of each country you touch in the Americas.

Let’s break it down. 🔍

First, the Big Picture: What Makes a Market Complex?

The most complex contingent markets — Brazil, Mexico, Argentina, Colombia — don’t just have one issue. They’ve got the full buffet: restrictive labor laws, high informality, rigid staffing models, and more bureaucratic red tape than a holiday gift-wrapping station.

The least complex? Canada and the U.S. 🇨🇦🇺🇸 They benefit from high MSP/VMS maturity, strong governance, competitive agency markets, and relatively light-touch employment regulation. Translation: you’ve got more tools, better infrastructure, and fewer bureaucratic potholes to blow out your tires on.

But don’t get too cozy. Low complexity doesn’t mean no risk. Every market has its own curveballs — you just need to know how to catch them (and when to duck).

Not All Complexity Is Created Equal 🧠

Here’s where some leadership teams go sideways: they treat complexity like a single, static score. It’s not.

A country might be easy to hire in but impossible to invoice through. Or great for rate negotiations but devoid of tech infrastructure. When you flatten complexity into a single dimension, you solve the wrong problems — beautifully and expensively.

Savvy leaders break it down:

Legal: Classification risk, subcontracting bans

Operational: MSP/VMS maturity, process bottlenecks

Talent: Access to ICs, labor shortages

Reputational: Governance, corruption, enforcement visibility

The trick? Know what kind of trouble you’re in before trying to fix it.

Stop Copy-Pasting Your U.S. Playbook

A classic mistake: deploying your well-oiled U.S. contingent strategy into São Paulo and expecting applause. What you’ll get instead is an inbox full of legal memos and a budget marked “pending review.”

Strategy should flex across three dimensions:

Engagement Models

Governance & Compliance

Supplier & Tech Strategy

Let’s unpack these — no buzzwords, just boots-on-the-ground reality.

1. Engagement Models: Pick the Right Tool for the Market 🛠️

In North America, the buffet is open — ICs, SOW, temps, freelancers, direct sourcing. Fill your plate.

But in Brazil or Mexico? The kitchen’s closed early, and someone hid the forks.

Mexico: Subcontracting was banned in 2021. Most models involving external staffing vendors are now under tight government scrutiny.

Brazil: A masterclass in bureaucratic endurance. High taxes, formalization issues, and a tight labor market make things... challenging.

🎯 Real-World Watchout: I once worked with a client who decided to launch a direct sourcing initiative in Mexico. Looked brilliant on paper. On the ground? Totally misaligned with new legislation. They had to tear it down and rebuild under a licensed staffing partner — three months of lost time and a budget that still winces when it hears the word "pilot."

💸 The Cost of Getting It Wrong: In many LATAM markets, contractor misclassification can cost you six figures — plus interest, backpay, and reputation damage. A short local compliance review can prevent a very long finance conversation.

✅ Tactical Tip: Map engagement models to local legal constraints. Don’t assume ICs are viable unless a lawyer in that country says so.

2. Governance & Compliance: The Invisible Minefield 💥

It’s not what’s in the law — it’s how it’s enforced (or... isn’t).

Colombia and Peru: High labor informality and inconsistent enforcement. What looks simple on paper can unravel fast in practice.

Uruguay: Stable but nuanced. Licensed suppliers need financial guarantees and a local presence.

👀 Pro Tip: Always ask, “How is this enforced locally?” not just “What does the law say?”

✅ Tactical Tip: Build a compliance radar. Know your top three risks in each market before onboarding a single supplier.

3. Supplier & Tech Strategy: Don’t Ship a Tesla to a Dirt Road ⚙️

MSP/VMS maturity varies wildly. Some markets aren’t ready for your fully integrated sourcing stack — and trying to force it in may just create more friction.

Canada and the U.S.: MSP-ready, VMS-saturated, plug-and-play.

Costa Rica and Chile: Middle ground. Tech-lite with room to grow.

Argentina, Peru: Manual first. Scale slowly. No fancy dashboards yet.

⚠️ Rolling out a global tech stack in an immature market is like trying to install a smart fridge in a tent — great idea, wrong infrastructure.

✅ Tactical Tip: Use a hub-and-spoke model. Centralize what you can, localize what you must.

Don’t Let Pricing Illusions Derail Strategy 💰

Thinking you’ll cut costs in Argentina or Peru through supplier rate pressure? Think again. Low competition + small supplier bases = low leverage.

In contrast, Canada is flush with firms, giving buyers serious negotiating room. The U.S. is somewhere in the middle — volume heavy, but still fragmented.

✅ Tactical Tip: Focus on cost efficiency — not just price per hour. The real savings come from reducing churn, rework, and noncompliance.

🧩 Pre-Expansion Sanity Check: 5 Questions to Keep You Honest

Before entering a new country, ask yourself:

✅ Are our engagement models locally compliant?

✅ Do we understand the real compliance risks?

✅ Can our tech stack flex to the local market?

✅ Are we assuming cost savings that don’t exist?

✅ Do we have anyone on the ground who speaks both the language and the culture?

If you answered “no” to any of the above, pause before you roll out. You’ll thank yourself later.

Culture Isn’t a Footnote — It’s a Risk Variable 🌎

You can have a compliant supplier that still causes chaos — because culture eats compliance for breakfast.

Tone, timing, hierarchy, and formality all shape vendor relationships. Especially in LATAM, where indirect communication is the norm and local nuance matters.

✅ If you’re entering a new market, make sure someone on your team speaks both the language and the mindset.

What’s Changing: The Future Isn’t Flat

Complexity is dynamic — not fixed.

📈 Nearshoring in LATAM is improving infrastructure

🤖 AI-driven compliance tools are boosting visibility

🌐 Digital staffing platforms may open up new engagement options (eventually)

But until automation replaces ambiguity — local context is your competitive edge.

Final Word: One-Size-Fits-None 🛡️

Complexity isn’t the enemy. Assumption is.

Markets like Brazil, Mexico, and Colombia will challenge your templates — and that’s a good thing. If you flex your strategy by market, complexity becomes navigable. If you don’t, it becomes expensive.

This is the kind of nuance I help leaders navigate when they’re looking to expand without stepping into regulatory quicksand.

Because in contingent workforce management, one-size-fits-all isn’t a strategy. It’s a liability. 😉

If you enjoyed this read, the best compliment I could receive would be if you shared it with one person or restacked it.

If you need support on your journey, upgrade to a paid subscription where you’ll instantly be able to interact with the community through group chat, live Q&A’s, gain access practical program tools and useful how-to guides.